|

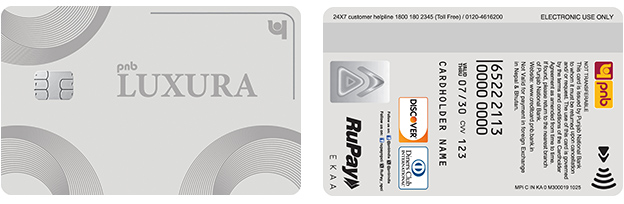

PNB Metal Credit Card "LUXURA" on RuPay

|

| |

| Age Criteria : |

21-70 Years |

Educational

Qualification : |

Literate |

| Income Criteria : |

For Salaried - Gross monthly salary of 1,50,000/- and above.

For Non salaried - Annual income of Rs. 18,00,000/- and above.

Against Fixed Deposit - Minimum ₹1.5 Lakh, sanctioned limit will be as per Bank's Policy. All other Financial/Service Charges applicable to the Luxura Credit Card issued against a fixed deposit shall be the same as those applicable to the normal Luxura Credit Card

|

| Credit Card Limit : |

Min - Rs. 1,00,000/-

Max. - Rs. 50,00,000/-*-*

*Limit will be assigned based on the Board approved Risk Underwriting Model.

|

| Fees : |

Joining Fee - Rs. 9000 + GST #

Annual Fee - Rs. 7500 + GST ##

# Joining Fee will be waived if total spend on the card exceed Rs 2,50,000 within three billing cycles from the date of issuance of the card .

## Annual fee will be waived if annual spends on the card exceeds Rs 8,00,000 from the date of issuance of card.

Replacement Fee - Rs. 4000 + GST.

|

Add-on Card : |

For Metal Card*:

Joining Fee - ₹9000 + GST

Annual Fee - ₹7500 + GST

For Non-Metal Card*:

Joining Fee - ₹6000 + GST

Annual Fee - ₹4500 + GST

*All benefits, joining fee reimbursement & annual fee waiver criteria will be same as primary card.

|

|

| Benefits and Features |

| Welcome Benefits : |

40,000 rewards point* on spend of Rs. 50k in 90 days |

| Milestone Benefits : |

10,000 reward points on spend of 5 lacs annually. |

| Brand-Specific Reward Multiplier : |

3X Reward Point on travel & dining spends. |

| Fuel surcharge Waiver : |

Min. Rs.12.50 or 1% on single fuel transaction of amount greater than Rs.500 & less than Rs.4000/-.

Maximum surcharge waiver up to Rs. 350/- within a billing cycle exclusive of service tax and other charges.

|

| Rewards Point : |

Earn 4 rewards points (Worth Rs. 1) for every Rs100/- spent. |

| Lounge Access : |

Unlimited Complementary Domestic & International Lounge Access |

| Forex Markup : |

Nil |

| Hospitality Benefit : |

2+1 Complimentary night

ITC (Premium Hotels other than Fortune) Throughout the year, any number of times.(Except blackout dates as per the hotel)

1+1 Dinning (Set Menu)

Set Menu at Signature ITC restaurants (Applicable restaurants - Peshawari/Avartana/Kebabs & Kurries/Royal Vega/DumPukht/ Yi Jing/Pan Asian/Ottimo Cucina Italiana) Throughout the year, any number of times, Max 1 per Table/Bill (Except blackout dates as per the hotel)

(Except blackout dates as per the hotel)

1+1 SPA

SPA for resident customers ITC (60 Mins),Throughout the year, any number of times.

|

|

| Memberships : |

HoteLux Membership

HoteLux operates as a high-end, member-based private travel agent, offering luxury travel experiences. HoteLux memberships are valid across luxury hotels and resorts which are as follows:

Hyatt, Hilton, AMAN, Rosewood, Virtuoso, accor, Cheval Blanc, Marriot, IHG, Shangri- La, Four Seasons, The Peninsula Hotels, IHG, Mandarin Oriental etc

The Elite Plus Membership includes:

Complimentary breakfast

Complimentary room upgrade*

Early check-in*

Late check-out*

Replacement Fee - Rs. 4000 + GST.

Up to US$200 in hotel dining & spa credits.

Up to US$200 in hotel dining & spa credits.

One-time use of 1,000 and 2,000 HoteLux Points (equivalent to USD 100 and USD 200)

*Subject to availability

These benefits are applicable across a wide network of luxury hotels listed on HoteLux Website .

|

| Movie Ticket : |

Buy 1 get 1 ticket up to INR 500 once a month

(Bookmyshow - from blocked no. of seats)

|

| Comprehensive Insurance Coverage : |

Personal Accidental Insurance: 50 Lakhs

Air Accidental Insurance: 1 Cr

Purchase Protection: 2 lakhs

Travel Insurance (Baggage Loss 20k)

|

| 24 by 7 Concierge : |

Domestic

Golf Reservations, Car Rentals, and travel reservation assistance, etc.

International

Lost passport & lost luggage assistance, Embassy & hospital assistance etc.

|

| Emergency Cash Concierge : |

International

In case of loss of wallet, cash support of $600 anywhere in globe.

|

| Golf : |

4 domestic complimentary golf lessons/rounds in a year (1 per quarter)

|

| Visa application services (OneVasco) : |

Complimentary lounge for 2 visitors (only for applicable Visa process) once per year, excluding business Visa.

15% Discount on Fast track immigration.

15% Discount on Visa concierge services.

|

|

|

|

|

| Important Message |

- Prevent fraud! PNB or its employees never ask for your details such as Card number, card expiry, CVV, OTP or password. Do not share these with anyone over call or email.

- For contactless transactions, i.e. transaction without dipping, swiping or PIN entry, a maximum limit of INR 5,000 is allowed for a single transaction.

|

|

|

|